In the vast majority of agreements, whenever renting a property, the deposit is paid before the tenancy begins, and is returned to the tenant upon leaving.

The amount of the deposit is written in the contract, and a receipt should be given to the tenant by the owner, as soon as it has been paid. The conditions attaining to the return of the deposit are also usually stated in the contract, however, if the conditions are not directly stipulated, the deposit should be returned providing the following are met:

- All bills are paid in full

- No damage, other than acceptable wear and tear

- The tenant did not break contract by leaving without providing 60-day notice* [Learn More Here]

- The tenant did not breach any other rules in the contract

Having Problems?

Unfortunately, some have encountered difficulties in obtaining their deposit after departure, and therefore we have the following advice.

1) Does the Owner Have Legal Grounds to Keep Your Deposit?

If you have met the conditions required for the return of your deposit, the owner has no legal right to keep the balance. Providing you have proof (either a receipt of payment or the original contract stating the deposit amount), you have legal grounds to demand the return of your deposit.

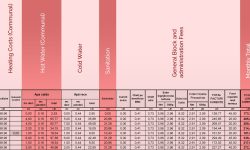

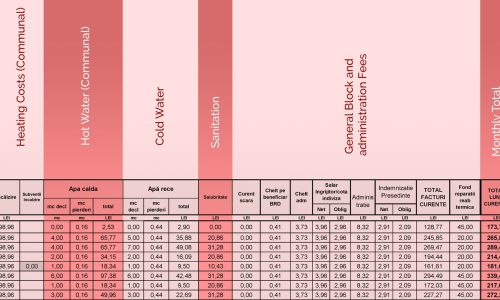

2) The Owner is Waiting for the Final Bills for the Previous Month.

This is quite common, and somewhat reasonable. However, it’s not reasonable for the owner to keep the entire deposit, unless they can clearly demonstrate that the bills will total the amount of your deposit.

The owner should request the final bills from the relevant service / utility provider, upon your departure, by subitting the index / usage amounts. The provider will be able to calculate the consumption, and offer a final bill.

The amount of this final bill can either be paid by the tenant, and request the full deposit return, or can be deducated against the deposit and the owner will then provide the tenant with the remainder of his / her balance.

3) The Owner has Refused to Return the Deposit, or is Not Responding to Requests.

If you suspect that the owner is purposely not returning your deposit, or has stated that they will not return your deposit, you may need to consider taking steps to remind them of their obligation.

In such situations, we advise you to do the following:

- Request from the owner, a copy of the original contract, which includes the fiscal stamp.

- Receipts for payments from the period of your tenancy.

- Request a written statement as to why they are refusing to return your deposit.

- Contact number for their attorney or legal advisor

The purpose of following these steps, is primarily to ensure that the owner knows that you understand your rights, and that by keeping the deposit, they could land themselves in legal trouble.

4) Prove Your Payments

You should have already kept receipts for payments that you have made during the period of your tenancy. By law the owner of the property is required to provide you with a receipt for any payments, including rent, that you have made to them directly.

You are responsible to retain receipts for payments that you have made personally to any company or service / utility provider. However, it’s not difficult to request these receipts if you require a copy.

If you were not provided with receipts for your rent, then you may need to provide evidence that you have paid your rent / bills through another means, such as:

- Direct Bank Transfer Statements

- Evidence of monthly withdraw of funds from a bank account for the amount of the rent

- Messages or other communications which refer to the collection or reception of payments

If you are able to provide any of the above, there should be little or no dispute with regards to the fact you have paid during your tenancy.

5) Obtain Legal Advice

Providing that you have solid grounds to request the return of your deposit, and the owner has nothing to the contrary, you may wish to request legal advice.

A lawyer will be able to contact the owner of the property on your behalf, and remind them of their obligation to return your deposit, as retaining the amount is affectively theft and possibly fraud.

They will also be able to determine, whether the contract was declared at the finance office. If a contract has not been declared at the finance office, then the property owner may have been comitting an offense. Tax fraud and failure to disclose income, is something that ANAF, (the agency for finance), take very seriously and can result in significant fines or even criminal sentences towards the owner.